Wealthing Like Rabbits

The keys to long lasting wealth

My parents have always emphasized the importance of personal finance. One of my moms ‘hobbies’ is reading personal finance books and articles… most of which are shared in our family group chat. One of her favourite books is ‘Wealthing Like Rabbits’ by Robert R Brown. Consequently, it was the book that introduced me into the world of finance.

I recently revisited the book as I wondered if there were any new lessons I could take from it, given that it’s been six years since I read it. Here is a list of the most important lessons I took from Wealthing Like Rabbits!

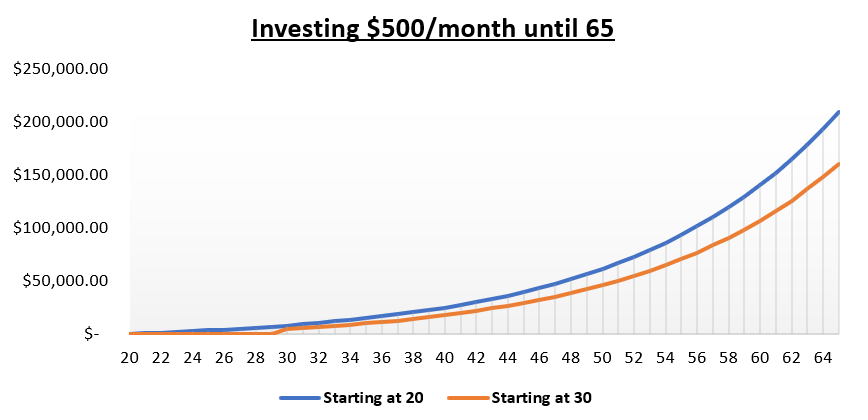

1. Start Early: Investing (for most people) should be about the long game. By starting early, you are taking advantage of the miracle of compound interest. The graph below shows the difference between investing $500 every month with an 8% return if you started from the age of 20 compared to starting from the age of 30 (in this scenario 30 year old invests a lump sum of $5000 to even the total invested by both parties):

If you started at the age of 20 investing $500/month, by the time you turn 65 you will have an account balance of $209,213.03, having invested $22,500; earning $186,713.03 in interest. If you started investing at 30 (with $5000 lump sump), by the time you turn 65 you will have an account balance of $160,085.12, having invested $22,500; earning $137,585.12 in interest.

In this scenario, by the time you retire, you will have $50,000 more if you started at 20 than at 30, investing the same total amount. Starting early makes the BIGGEST difference when it comes to investing. Every single contribution matters, no matter how small.

2. Budgeting Matters: Creating and sticking to a budget is essential for managing your finances effectively. Having a budget doesn’t necessarily mean you have to reduce spending. It’s more for the purpose of tracking your income/expenses.

As a university student, I am all too familiar with the feeling Sunday morning of “god I don’t even want to know what I spent this weekend”. It’s a feeling (coupled with a hangover) that no one likes to have. But the best way to confront that feeling is just by checking and accounting for the 'financial damage’ that weekend caused. By doing this, you can be mindful of how certain spending patterns affect your financial standing. Once you realize that spending $60 at Kentucky Bourbon & BBQ every Thursday brings your that much pain to look at, you’ll probably start changing how that $60 is spent.

The more conscious you are about what comes in and what goes out, the more you want to increase what your making and decrease what your spending. Saving/investing becomes an addiction when you see your totals increasing every day.

There are plenty of ways to track your income/expenses. You can choose between apps like YNAB, Mint, and Goodbudget, or you can do what I prefer, which is to create your own Excel sheet that you can personalize. It takes a bit of time, but once you finish it, you’re more incentivized to use it because I put time into it. But it doesn’t matter how you track your income/expenses as long as you are tracking them.

3. Pay Yourself First: Prioritize investing/saving by automatically setting aside a portion of your income before paying bills or indulging in discretionary expenses. By allocating your investments and savings first, you shrink the size of the pie available for discretionary spending. It forces you to make important choices on what you spend your money on while ensuring that you are investing/saving consistently. Making investing/saving a priority helps build a financial safety net while achieving long-term goals.

4. Avoid Debt Traps: Don’t fall into excessive debt, especially for reasons of overspending. Be mindful of borrowing habits taking into account and understanding interest rates as well as the difference between good debt and bad debt.

Good debt: Borrowing money for the purpose of achieving a positive ROI. It is generally considered a positive form of debt because it can contribute to financial growth and provide opportunities for wealth creation.

Mortgages/real estate investments

Education loans (in some cases)

Business loans

Investments

Bad Debt: Borrowing money for non-essential purchases or items not generating long-term value or appreciation. It is generally considered a negative debt because it can lead to financial difficulties and hinder financial progress.

Credit card debt

Payday loans

Large car debt

High-Interest Personal Loans

Make conscious decisions to avoid getting trapped in an endless cycle of debt. Only pay for what you can afford.

5. Invest Wisely: Investing is a long game. Most people aren’t investing to take advantage of the current market bull run. In the short term, markets are volatile and will go through long periods of growth followed by long periods of contraction. However, in the long run, these fluctuations will result in an overall positive return. The S&P 500 has returned an average of %11 per year since 1929 despite facing 11 economic recessions. So don’t try to time the market, as it’s almost impossible, and those who try to time it often miss out on the biggest gains. Invest consistently and try not to pay attention too much to what markets do in the short run.

As for what you invest in, talk to your investment advisor, and together you’ll make decisions based on your income, age, and financial standing.

6. Educate Yourself: Financial literacy is crucial. It’s a shame that they don’t teach it in school because it is one of the most important things you can learn. There are plenty of really good books on the subject, including this one! A few that I would suggest are:

Rich Dad Poor Dad - Robert Kiyosaki

Think and Grow Rich - Napoleon Hill

A Random Walk Down Wall Street - Burton Malkiel

The Little Book of Common Sense Investing - John C. Bogle

Lords of Finance - Liaquat Ahamed (not really a personal finance or investing book but a fascinating book about the history of central banking… one of my favourites)

The Alchemy of Finance - George Soros (I have not read this book yet however it is next on my list of finance books & I’m really looking forward to getting into it)

Educating yourself financially doesn’t mean you have to become a finance guru. Understanding the basics of investing, how money flows through the economy, and how to set yourself up for financial success is all you really need to know.

7. Set Realistic Goals: The book emphasizes the importance of realistic financial goals. However, I only partially agree with this point. It’s important to set realistic expense management goals ex: “I’m going to safe 20% of what I make”. Setting goals to manage expenses can be very effective for controlling where and how you spend your money. But when it comes to income/investments/savings, I disagree with setting ‘realistic’ goals. I think ‘realistic’ regarding these factors carries a different weight. It is heavily attached to the average of your field or age: “You should have $50,000 saved by the time you’re 30”. Yes, these are good comparative benchmarks, however, I don’t think the ‘realistic’ goal you have should be tied to any average. You should aim as high as your mind can fathom and then figure out ways to make that become your reality. If you shoot for the stars, and you miss, you’ll land on the moon. Don’t try to be just ‘average’.

8. Take Action: The most important thing to take away from this book is just take action. Take action in your financial life: be mindful of your finances, invest early, and never stop educating yourself on the beauty of personal finance.

These lessons provide a snapshot of the valuable personal finance advice offered in "Wealthing Like Rabbits" and if followed with consistency, can improve not only your financial wellbeing but your overall life. I would suggest reading the book as it is not only a very informative read but is also a very easy/enjoyable read.